Impact: Delivered two bank-approved registration flows that reduced ambiguity, prevented downstream payment failures, and met strict compliance requirements.

Designing a compliant registration experience under bank and regulatory constraints

After

Users redeeming virtual prepaid cards were encountering a fragmented and confusing registration experience that created friction at a critical moment: accessing funds.

However, the core challenge wasn’t simply usability. The flow operated inside a highly regulated environment where:

Cardholder agreement consent must be legally valid

Registration and billing requirements vary by card program

Language and interaction patterns must meet external bank expectations

Designs must pass third-party bank review before launch

The risk wasn’t just drop-off — it was compliance failure, invalid agreement acknowledgment, and payment declines caused by missing billing information.

The problem became a balancing act:

The Challenge: Reducing friction without violating compliance

“ How do you create a clear, confidence-building experience while enforcing non-negotiable legal and banking requirements?”

What success looked like

Success was not defined by conversion optimization or experimentation velocity.

Instead, this project was successful if we could:

Deliver approval-ready UX flows aligned with legal and banking standards

Eliminate ambiguity around when registration or billing information was required

Ensure explicit, valid cardholder agreement acknowledgment in all cases

Reduce the risk of payment failures caused by missing billing data

Increase confidence among compliance, legal, and banking stakeholders

Existing design

Key insight: Ambiguity was the real friction

Research and stakeholder review revealed that users weren’t necessarily resistant to providing information — they were unsure why it was being requested and whether it applied to them.

The existing experience blended multiple compliance requirements into a single, unclear path. This created hesitation, invalid agreement acknowledgment, and downstream payment issues.

The insight that shifted the approach:

Clarity and predictability mattered more than speed or flexibility.

Constraints that shaped the solution

This project was defined by real-world constraints that narrowed the solution space:

Non-negotiable requirements

Cardholder agreement must always be required

Agreement may need to be opened and viewed, not just checkbox-acknowledged

Some card programs require billing information; others explicitly do not

Designs must be suitable for external bank review

Explicit exclusions

No “Send gift,” offers, or promotional badges

Avoid the term “account” — use neutral language

Use “My Prepaid Center” branding only

These constraints eliminated many common UX patterns and required the solution to be predictable, conservative, and defensible.

Design approach: Clarity over conditional complexity

Rather than introducing conditional logic or optional paths that could confuse users or reviewers, I focused on creating clear, linear, and compliance-aligned flows.

The approach centered on:

Reducing cognitive load through predictable, step-by-step progression

Separating banking requirements cleanly by card program

Removing optional UI patterns that introduced interpretation risk

Using terminology and structure aligned with legal and banking expectations

The goal was to help users move forward confidently without asking them to interpret compliance rules themselves.

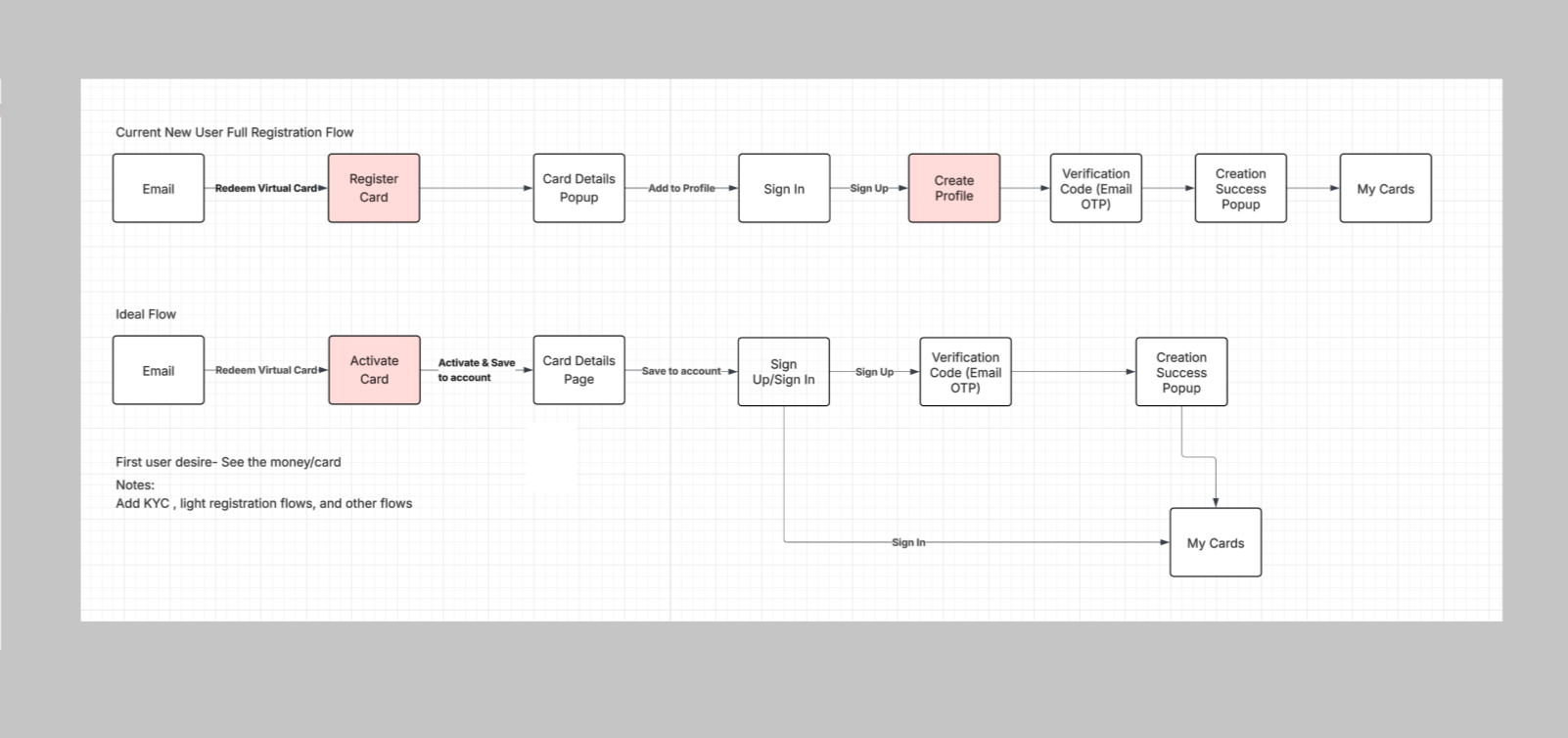

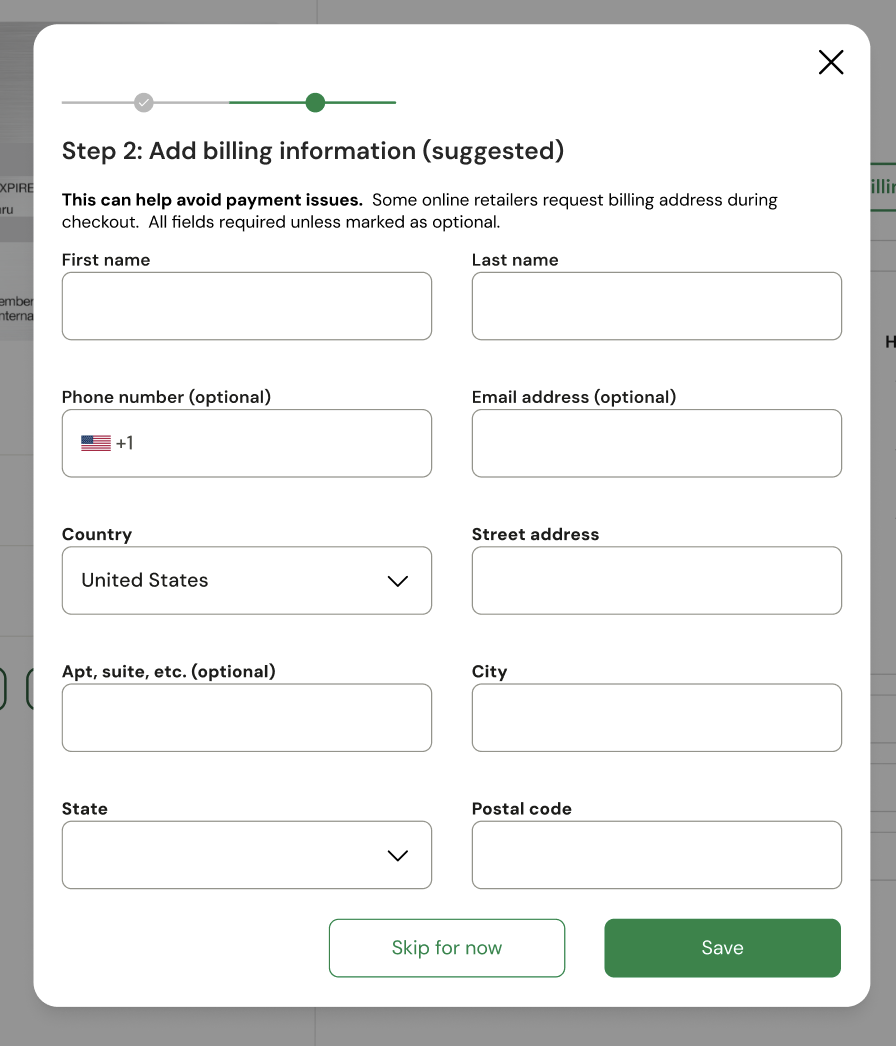

Key design decision: Two explicit registration flows

Instead of a single adaptive flow, I designed two clearly defined, approval-ready experiences, each aligned to a specific set of banking requirements.

This reduced ambiguity for users and simplified review for external banking partners.

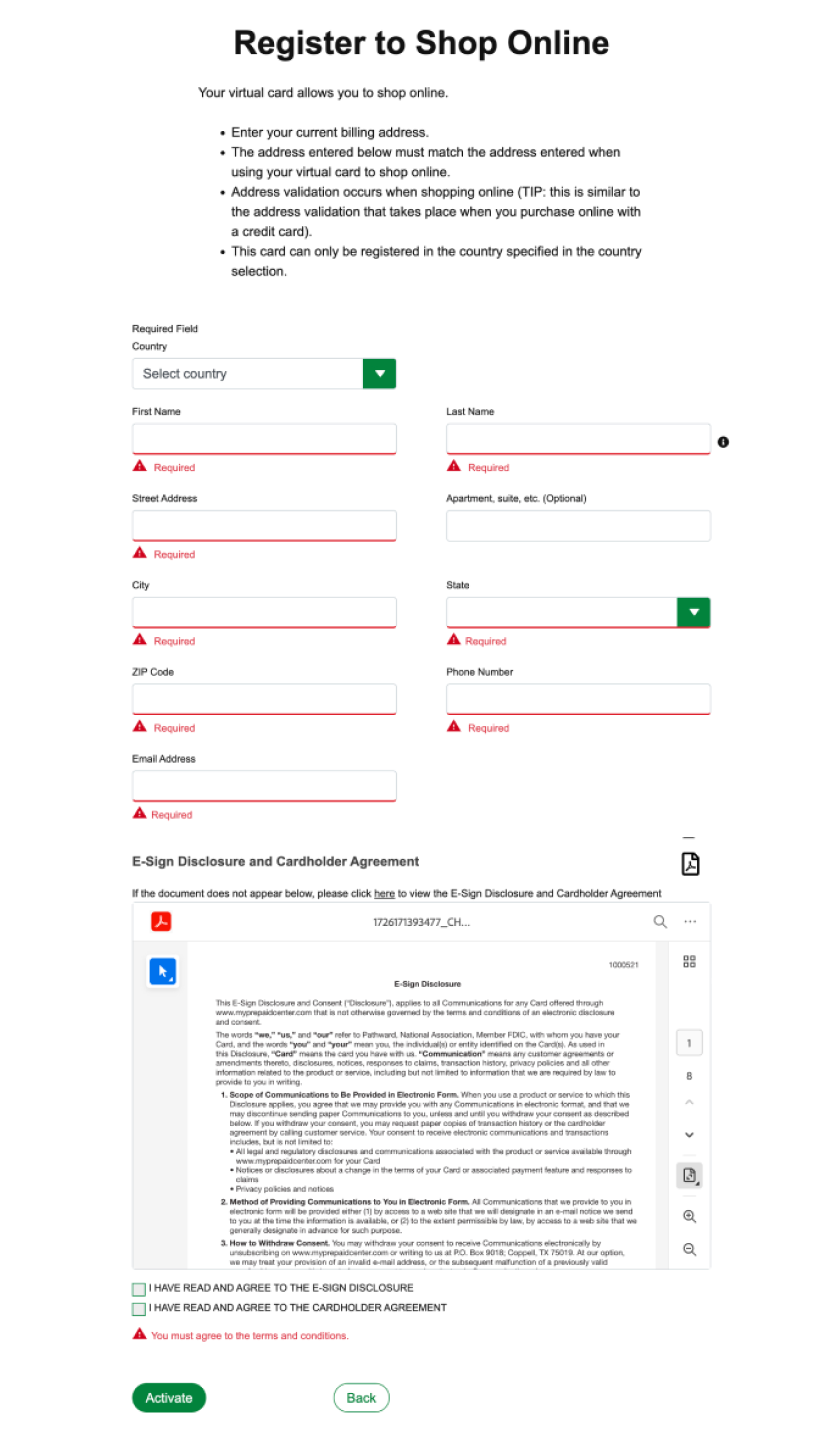

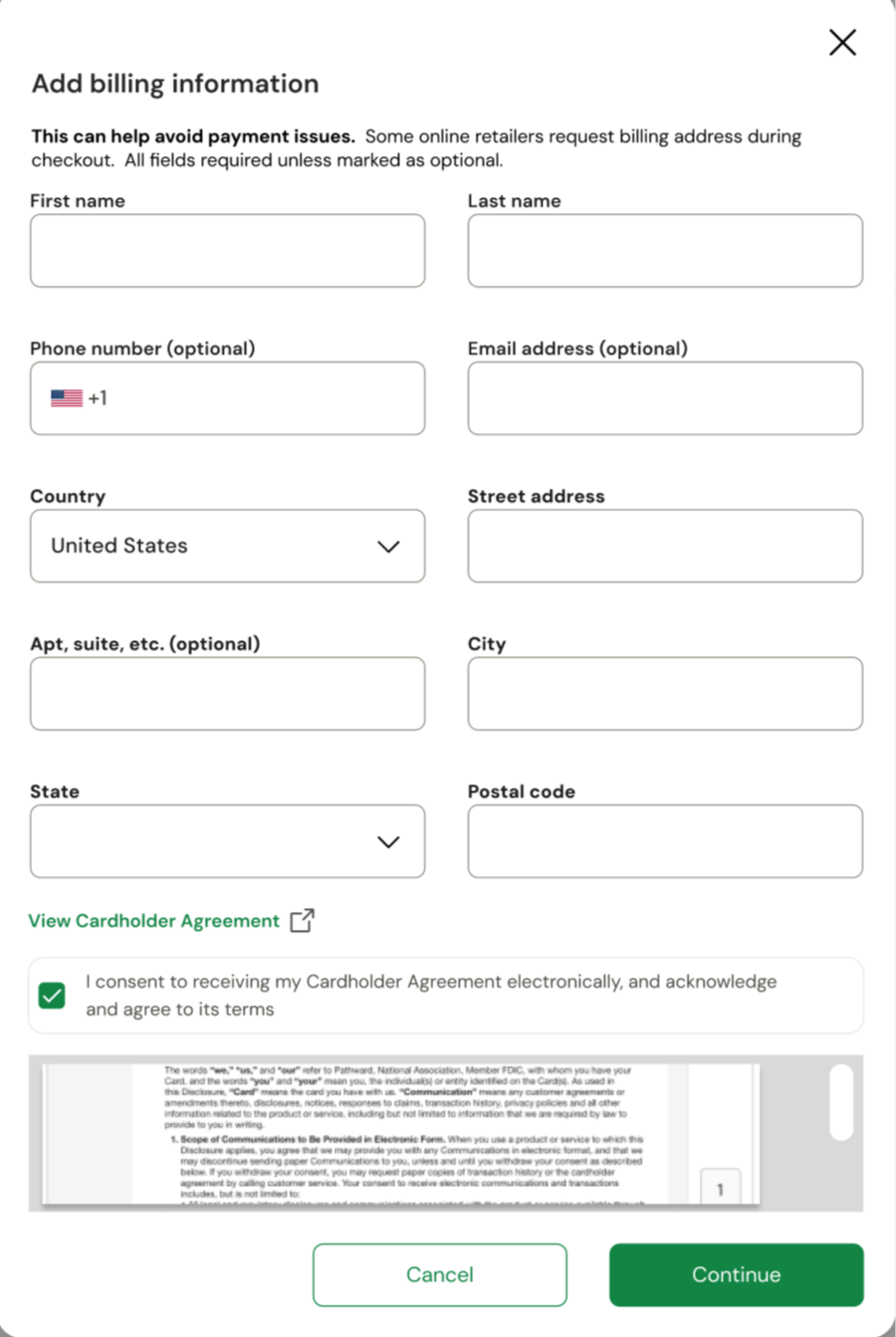

Flow 1: Registration + Billing Information Required

For card programs that require billing information to prevent payment issues:

Registration is required

Billing information is required

Cardholder agreement is mandatory and enforced

The flow activates the card and saves it to the user profile in one continuous experience

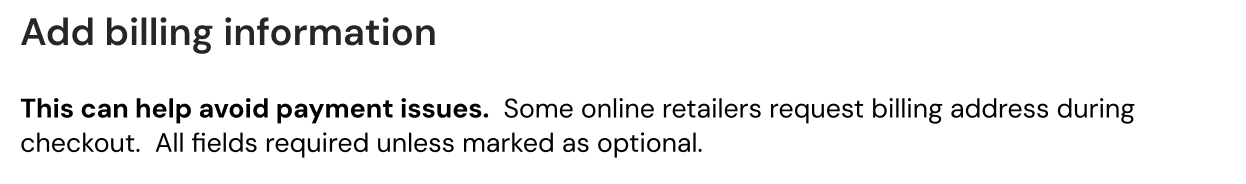

Billing information is framed as preventative and supportive, helping users avoid future payment declines rather than presenting it as a barrier.

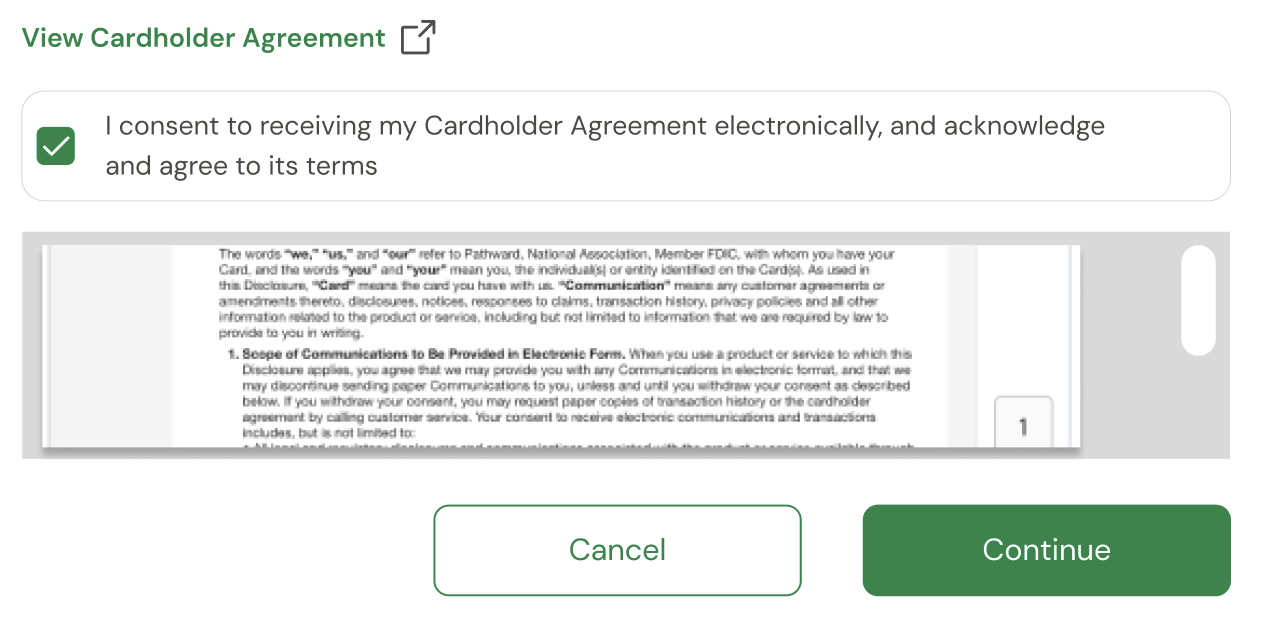

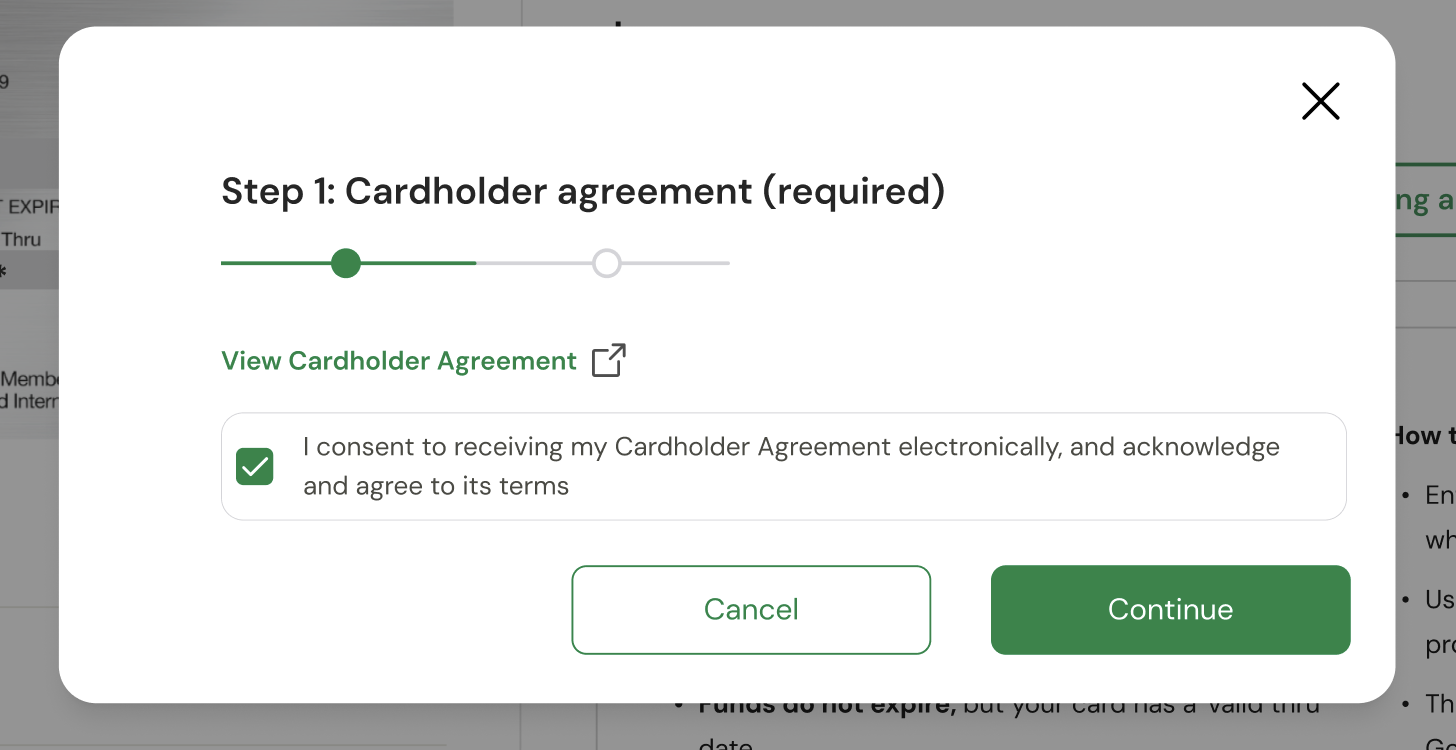

Flow 2: No Billing Information Required

For card programs that do not require billing information:

Registration is not required

Billing information is not required

Cardholder agreement is still mandatory

The agreement is surfaced in a focused, interruption-based step before continuation, ensuring explicit legal consent while prioritizing fast access to funds.

Outcomes

2 bank-approved registration flows delivered

Reduced ambiguity around registration and billing requirements

Clearer, more predictable onboarding for first-time users

Lower risk of invalid cardholder agreement consent

Reduced likelihood of payment declines due to missing billing information

Increased confidence from legal, compliance, and banking stakeholders

Why this work matters

This project demonstrates senior-level design thinking in a real production environment — where success is defined by alignment, risk mitigation, and system constraints, not just UI polish.

The value wasn’t in experimentation or visual refinement, but in delivering approval-ready UX that balanced user needs, business goals, and regulatory realities.

It’s an example of designing inside complex systems — where shipping means satisfying external partners and legal requirements, not just internal teams.